Best Forex Brokers Around The World: Comprehensive Guide Reviews, help you to choose the best broker for forex trading and investments. Embarking on a journey into the world of Forex trading? Your choice of a broker can make all the difference.

In this post, we’ve scoured the globe to bring you insights and reviews of the best Forex brokers, helping you navigate the complexities of the international Forex market with confidence.

How to choose the best forex brokers

OctaFX Review

Company Overview: OctaFX was founded in 2011 and has rapidly gained recognition in the online trading industry for its commitment to providing traders with excellent trading services.

Product Offering: OctaFX offers access to a wide range of financial instruments, including forex currency pairs, commodities, indices, and cryptocurrencies. It caters primarily to retail traders.

Regulation: The broker operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC) and is subject to European financial regulations, providing a level of client fund protection.

Trading Platforms: OctaFX offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are renowned for their advanced charting tools, technical analysis features, and automated trading capabilities.

Global Presence: With clients in over 100 countries and multilingual support, OctaFX serves a diverse international client base, providing access to global financial markets.

Educational Resources: OctaFX provides educational materials, including webinars, articles, video tutorials, and market analysis, to assist traders in improving their trading knowledge and skills.

Customer Support: The broker offers customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: OctaFX offers risk management tools like stop-loss and take-profit orders to help traders manage their positions and control risk.

Leverage and Risk: Leverage is available, but traders are encouraged to use it responsibly, as it can magnify both profits and losses. Effective risk management is emphasized.

Demo Accounts: Traders can open demo accounts to practice trading strategies and become familiar with the platform without risking real capital.

Fees and Commissions: OctaFX typically offers competitive spreads and low fees, making it an attractive choice for traders looking for cost-effective trading.

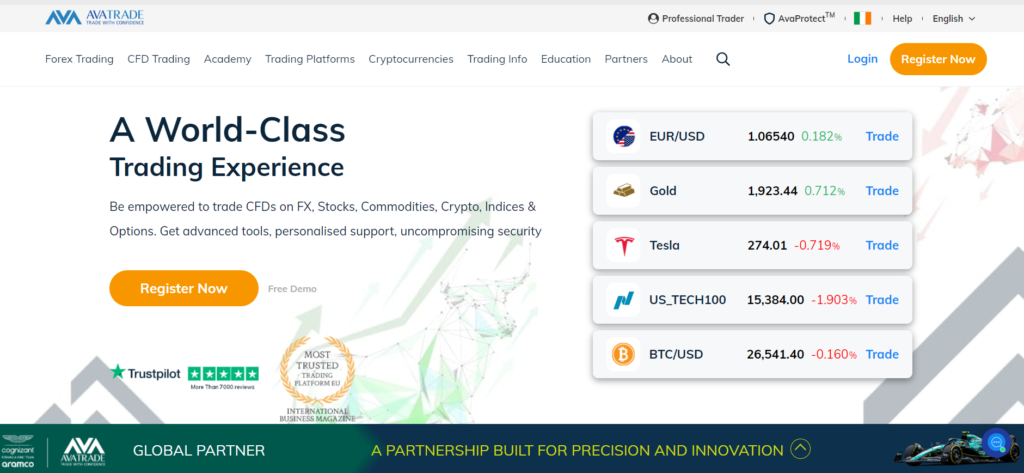

AvaTrade Review

Company Overview: AvaTrade was founded in 2006 and has since become a prominent name in the online trading industry, known for its user-friendly platforms and a wide range of trading instruments.

Product Offering: AvaTrade offers access to a diverse selection of financial instruments, including forex currency pairs, commodities, indices, stocks, bonds, and cryptocurrencies. It caters to both individual retail traders and institutional clients.

Regulation: The broker is regulated by multiple financial authorities in various jurisdictions, providing a high level of trust and security for client funds and operations.

Trading Platforms: AvaTrade offers a choice of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced features, customizable interface, and algorithmic trading capabilities. Additionally, AvaTrade provides its proprietary platform called AvaTradeGO.

Global Presence: With offices in multiple countries, AvaTrade serves a global client base, offering access to international financial markets.

Educational Resources: AvaTrade provides a range of educational materials, including webinars, articles, video tutorials, and market analysis, to assist traders in improving their trading knowledge and skills.

Customer Support: The broker offers customer support services through various channels, such as phone, email, and live chat, to assist clients with inquiries and technical issues.

Risk Management: AvaTrade offers risk management tools like stop-loss and take-profit orders to help traders manage their positions and protect their investments.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can magnify both gains and losses. Effective risk management is essential.

Demo Accounts: Traders can open demo accounts to practice trading strategies and get acquainted with the platform without risking real money.

Fees and Commissions: It’s important for traders to understand the fee structure, spreads, and commissions associated with their chosen account type and trading activities.

IC Market

Company Overview: IC Markets was founded in 2007 and has since gained a reputation as one of the world’s leading online forex brokers, catering to both retail traders and institutional clients.

Product Offering: IC Markets provides access to a broad range of financial instruments, including forex currency pairs, commodities, indices, cryptocurrencies, and bonds, offering diverse trading opportunities.

Regulation: The broker is regulated by multiple financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Services Authority (FSA), ensuring a high level of regulatory compliance and client fund security.

Trading Platforms: IC Markets offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced charting tools, technical analysis features, and algorithmic trading capabilities.

Global Presence: With a global client base and multilingual support, IC Markets serves traders and investors from various countries, providing access to international financial markets.

Educational Resources: The broker offers educational materials, webinars, articles, and trading tools to help traders enhance their trading knowledge and skills.

Customer Support: IC Markets provides customer support services through various channels, including phone, email, live chat, and a client portal, assisting clients with inquiries and technical issues.

Risk Management: IC Markets offers risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and control risk effectively.

Leverage and Risk: Leverage is available but should be used responsibly, as it can magnify both profits and losses. IC Markets encourages prudent risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and get acquainted with the platform without risking real capital.

Fees and Commissions: IC Markets is known for its competitive spreads, low fees, and transparent fee structure, making it attractive to cost-conscious traders.

Interactive Brokers

Company Overview: Interactive Brokers, often referred to as IBKR, is a leading online brokerage founded in 1978. It’s known for its cutting-edge technology and broad access to financial markets.

Product Offering: The company offers a wide range of financial instruments for trading, including stocks, options, futures, forex, bonds, and more, catering to both retail and institutional clients.

Trading Platforms: Interactive Brokers provides its proprietary trading platform called Trader Workstation (TWS), as well as access to third-party platforms like MetaTrader 4 and 5 (MT4/MT5). TWS is known for its advanced features and customizable interface.

Global Presence: Interactive Brokers has a global reach, with offices and clients in numerous countries, making it accessible to traders worldwide.

Regulation: The company is heavily regulated and subject to oversight by multiple financial authorities, which enhances the security and safety of client funds.

Low-Cost Trading: Interactive Brokers is often recognized for its low-cost trading model, offering competitive pricing on commissions and fees, which can be particularly attractive to frequent traders.

Leverage and Risk: Traders can utilize leverage, but they should be cautious as it can amplify both profits and losses. Risk management is essential when using leverage.

Research and Analysis: Interactive Brokers provides a variety of research tools, market data, and analysis resources to assist traders in making informed investment decisions.

Customer Support: The company offers customer support services via phone, email, and chat to assist clients with inquiries and technical issues.

Interactive Advisors: Interactive Brokers also offers a robo-advisory service known as Interactive Advisors, allowing clients to invest in portfolios managed by automated algorithms.

API Access: It provides API (Application Programming Interface) access for traders and developers to create custom trading applications and algorithms.

Risk Management Tools: Interactive Brokers offers risk management tools, including stop-loss orders and risk assessments, to help traders protect their capital.

Account Types: Various account types are available, including individual, joint, corporate, and retirement accounts, to suit different client needs.

IG (IG Markets)

Company Overview: IG is a well-established global brokerage and financial services provider founded in 1974. It has a long history in the financial industry and is recognized for its reliability and innovation.

Product Offering: IG offers access to a wide range of financial markets, including forex, stocks, indices, commodities, cryptocurrencies, and more. It serves both retail and institutional traders.

Regulation: The company is highly regulated, adhering to the oversight of several financial authorities globally. This regulatory oversight ensures the safety and security of client funds and operations.

Trading Platforms: IG provides its proprietary trading platform, known as the IG Trading Platform, which is known for its user-friendly interface and advanced charting tools. Additionally, traders can use MetaTrader 4 (MT4) for their trading activities.

Global Presence: IG has a global presence with offices and clients in numerous countries, making it accessible to traders and investors worldwide.

Educational Resources: The platform offers a range of educational materials, including webinars, articles, tutorials, and market analysis, to help traders enhance their knowledge and skills.

Customer Support: IG offers customer support services through various channels such as phone, email, and live chat to assist clients with inquiries and technical issues.

Risk Management: IG provides risk management tools like stop-loss orders and guaranteed stop-loss orders to help traders manage their positions and mitigate risk.

Leverage and Risk: Leverage is available, but traders should exercise caution as it can amplify both profits and losses. It’s crucial to employ risk management strategies.

Demo Accounts: Traders can open demo accounts to practice trading strategies and gain familiarity with the platform without risking real capital.

Fees and Commissions: Traders should be aware of the fee structure, spreads, and commissions associated with their chosen account type and trading activities.

FOREX.com

Company Overview: FOREX.com is a widely recognized online forex trading broker and a subsidiary of GAIN Capital Holdings, Inc. The company has been providing forex trading services since its establishment in 1999.

Product Offering: FOREX.com offers access to a broad range of financial instruments, including forex currency pairs, commodities, indices, and cryptocurrencies. It caters to both retail and institutional traders.

Regulation: The broker is regulated by several financial authorities in different regions, enhancing the security and transparency of client funds and transactions.

Trading Platforms: FOREX.com offers its proprietary trading platform, known as the Advanced Trading Platform, which is user-friendly and feature-rich. Additionally, traders can use the popular MetaTrader 4 (MT4) platform.

Global Reach: The platform has a global presence, serving clients in numerous countries, making it accessible to traders worldwide.

Educational Resources: FOREX.com provides educational materials, including webinars, articles, tutorials, and a comprehensive trading academy to help traders improve their skills and knowledge.

Customer Support: The broker offers customer support services through various channels, such as phone, email, and live chat, to assist traders with inquiries and technical issues.

Risk Management: FOREX.com provides risk management tools, including stop-loss orders and take-profit orders, to help traders manage their positions and protect their capital.

Leverage and Risk: Like other forex brokers, FOREX.com offers leverage, which can amplify both profits and losses. Traders should exercise caution and employ proper risk management strategies.

Demo Accounts: Traders can open demo accounts to practice trading strategies and familiarize themselves with the platform without risking real money.

Fees and Commissions: It’s important for traders to understand the fee structure, spreads, and commissions associated with their chosen account type and trading activities.

eToro

Company Overview: eToro was founded in 2007 and has since become a prominent online trading platform, known for its unique social trading features.

Product Offering: eToro offers access to a wide range of financial instruments, including stocks, cryptocurrencies, forex, commodities, indices, and more. It caters to both retail and professional traders.

Social Trading: One of eToro’s standout features is its social trading network, which allows users to follow and copy the trading strategies of experienced traders. This social aspect makes it a popular choice for beginners looking to learn from experts.

Regulation: The platform is regulated by various financial authorities, providing a secure and trustworthy trading environment for its users.

Trading Platforms: eToro offers a user-friendly, web-based trading platform that is accessible via desktop and mobile devices. The platform’s intuitive design makes it easy for traders of all levels.

Global Presence: eToro has a global reach, serving clients in many countries around the world. Its accessibility has contributed to its popularity.

Educational Resources: eToro provides educational resources, including webinars, tutorials, and market analysis, to help traders improve their trading knowledge and skills.

CopyPortfolio: In addition to individual traders, eToro offers a feature called CopyPortfolio, where traders can invest in portfolios of assets created by eToro’s experts based on specific themes or strategies.

Customer Support: The platform offers customer support services through email and a knowledge base to assist users with their inquiries and issues.

Risk Management: eToro provides risk management tools, including stop-loss orders and take-profit orders, to help traders protect their investments.

Leverage and Risk: Leverage is available, but users should be cautious as it can magnify both profits and losses. Responsible risk management is essential.

Demo Accounts: eToro offers demo accounts for users to practice trading strategies and familiarize themselves with the platform without risking real capital.

Fees and Commissions: Traders should be aware of eToro’s fee structure, which includes spreads and, in some cases, overnight financing fees.

OANDA

Company Overview: OANDA, founded in 1996, is one of the oldest online forex brokers. It has a strong reputation for transparency and innovation in the forex trading industry.

Product Offering: OANDA offers access to various financial instruments, including forex currency pairs, commodities, indices, and precious metals. It caters to both individual retail traders and institutional clients.

Regulation: The broker is highly regulated and subject to oversight by multiple financial authorities globally, ensuring the security of client funds and adherence to strict industry standards.

Trading Platforms: OANDA provides its proprietary trading platform called OANDA Trade and also supports the MetaTrader 4 (MT4) platform, known for its advanced charting and analysis tools.

Global Presence: OANDA serves clients in various countries, making it a globally accessible platform for forex trading and investment.

Educational Resources: OANDA offers educational materials, webinars, articles, and tutorials to help traders improve their trading knowledge and skills.

Customer Support: The broker provides customer support services through various channels, including phone, email, and live chat, to assist traders with inquiries and technical issues.

Risk Management: OANDA offers risk management tools such as stop-loss orders and take-profit orders to help traders manage their positions and mitigate potential losses.

Leverage and Risk: Leverage is available, but traders should use it cautiously, as it can amplify both profits and losses. Employing proper risk management is crucial.

Demo Accounts: OANDA allows traders to open demo accounts to practice trading strategies and gain familiarity with the platform without risking real capital.

Fees and Commissions: Traders should be aware of OANDA’s fee structure, which typically includes spreads and, in some cases, overnight financing fees.

TD Ameritrade

Company Overview: TD Ameritrade was a well-established online brokerage founded in 1975. It was known for its comprehensive suite of investment and trading services.

Product Offering: The firm offered a wide range of financial products and services, including stock trading, options trading, futures trading, forex trading, and access to exchange-traded funds (ETFs) and mutual funds.

Regulation: TD Ameritrade was regulated by multiple financial authorities in the United States, providing a high level of security and compliance with regulatory standards.

Trading Platforms: TD Ameritrade provided its proprietary trading platform, thinkorswim, which was celebrated for its advanced features, technical analysis tools, and customizable interface.

Global Presence: While primarily serving clients in the United States, TD Ameritrade had a significant domestic presence, making it a popular choice for U.S.-based investors and traders.

Educational Resources: The platform offered extensive educational resources, including webinars, articles, tutorials, and a trading community, to help clients improve their trading knowledge.

Customer Support: TD Ameritrade offered robust customer support services through phone, email, live chat, and in-person assistance at local branch offices.

Risk Management: The platform provided risk management tools such as stop-loss and limit orders to help traders protect their investments.

Leverage and Risk: Like many U.S. brokers, TD Ameritrade offered limited leverage, especially in forex trading, to mitigate potential risks.

Fees and Commissions: Clients were subject to trading commissions and fees, which were competitive within the industry.

Saxo Bank

Company Overview: Saxo Bank, founded in 1992, is a leading global fintech and banking institution headquartered in Denmark. It is renowned for its cutting-edge trading technology and extensive asset offerings.

Product Offering: Saxo Bank provides access to a wide array of financial instruments, including forex currency pairs, stocks, commodities, indices, bonds, cryptocurrencies, and more. It caters to both individual retail traders and institutional clients.

Regulation: The bank is regulated by multiple financial authorities in various countries, offering a high level of trust and security for client funds and operations.

Trading Platforms: Saxo Bank offers its proprietary trading platform, SaxoTraderGO, and SaxoTraderPRO, designed for professional traders. These platforms are known for their advanced charting tools and customization options.

Global Presence: With a presence in multiple countries, Saxo Bank serves clients from around the world, providing access to global financial markets.

Educational Resources: The bank offers educational materials, including webinars, articles, research reports, and trading tools to help traders and investors make informed decisions.

Customer Support: Saxo Bank provides customer support through various channels, including phone, email, and live chat, to assist clients with inquiries and technical issues.

Risk Management: The bank offers risk management features like stop-loss orders and take-profit orders to help traders protect their capital.

Leverage and Risk: Saxo Bank offers leverage, but traders should exercise caution as it can magnify both gains and losses. Effective risk management is essential.

Demo Accounts: Traders can open demo accounts to practice trading strategies and get accustomed to the platform without risking real capital.

Fees and Commissions: Clients should be aware of Saxo Bank’s fee structure, which includes spreads, commissions, and potential overnight financing charges.

Company Overview: Pepperstone was founded in 2010 and has since grown to become a leading online broker in the forex and CFD trading industry. It is headquartered in Australia.

Product Offering: Pepperstone provides access to a wide range of financial instruments, including forex currency pairs, commodities, indices, cryptocurrencies, and shares. It caters to both individual retail traders and professional clients.

Regulation: The broker is regulated by multiple financial authorities in different countries, including ASIC in Australia and the FCA in the United Kingdom, ensuring a high level of regulatory oversight and security for client funds.

Trading Platforms: Pepperstone offers a choice of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its own platform, cTrader. These platforms are known for their advanced charting tools and execution speed.

Global Presence: With offices in several countries, Pepperstone serves traders and investors worldwide, providing access to global financial markets.

Educational Resources: The broker offers educational materials, webinars, market analysis, and trading tools to assist traders in improving their trading knowledge and skills.

Customer Support: Pepperstone provides customer support through various channels, such as phone, email, and live chat, to assist clients with inquiries and technical issues.

Risk Management: Pepperstone offers risk management tools, including stop-loss and take-profit orders, to help traders protect their investments.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can amplify both profits and losses. Effective risk management is crucial.

Demo Accounts: Traders can open demo accounts to practice trading strategies and get comfortable with the platform without risking real capital.

Fees and Commissions: Pepperstone is known for its competitive pricing structure, which includes tight spreads and low commissions, making it attractive to cost-conscious traders.

FXCM

Company Overview: FXCM was established in 1999 and has become a prominent player in the online trading industry, providing access to various financial markets.

Product Offering: FXCM offers a wide range of financial instruments, including forex currency pairs, commodities, indices, and cryptocurrencies. It serves both individual retail traders and institutional clients.

Regulation: The broker is regulated by multiple financial authorities globally, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC), ensuring regulatory compliance and client fund safety.

Trading Platforms: FXCM provides traders with access to the popular MetaTrader 4 (MT4) platform, known for its advanced charting tools, technical analysis features, and automated trading capabilities.

Global Presence: With offices in various countries, FXCM serves a global client base, providing access to international financial markets.

Educational Resources: FXCM offers educational materials, webinars, articles, and trading tools to help traders enhance their knowledge and trading skills.

Customer Support: The broker provides customer support services through phone, email, and live chat to assist clients with inquiries and technical issues.

Risk Management: FXCM offers risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and protect their capital.

Leverage and Risk: FXCM provides leverage, but traders should use it responsibly, as it can magnify both profits and losses. Effective risk management is crucial.

Demo Accounts: Traders can open demo accounts to practice trading strategies and get familiar with the platform without risking real money.

Fees and Commissions: FXCM’s fee structure typically includes spreads, and it may offer commission-based accounts. Traders should be aware of the associated costs.

FXTM (ForexTime)

Company Overview: FXTM was founded in 2011 and has grown to become a reputable broker in the forex industry, known for its commitment to innovation and client-focused services.

Product Offering: FXTM offers access to a wide range of financial instruments, including forex currency pairs, commodities, indices, stocks, and cryptocurrencies. It caters to both retail and professional traders.

Regulation: FXTM is a regulated broker and operates under the oversight of multiple financial regulatory authorities in various countries, ensuring client fund security and regulatory compliance.

Trading Platforms: The broker provides popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), renowned for their advanced charting tools, technical analysis features, and automated trading capabilities.

Global Presence: With a presence in numerous countries, FXTM serves clients from around the world, offering access to global financial markets.

Educational Resources: FXTM offers a wide range of educational materials, including webinars, articles, tutorials, and market analysis, to help traders enhance their trading knowledge and skills.

Customer Support: The broker offers customer support services through various channels such as phone, email, and live chat, assisting clients with inquiries and technical issues.

Risk Management: FXTM provides risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and mitigate potential losses.

Leverage and Risk: Leverage is available, but traders should use it judiciously, as it can amplify both profits and losses. Effective risk management is essential.

Demo Accounts: Traders can open demo accounts to practice trading strategies and gain familiarity with the platform without risking real capital.

Fees and Commissions: It’s important for traders to understand the fee structure, spreads, and commissions associated with their chosen account type and trading activities.

XM

Company Overview: XM was founded in 2009 and has emerged as a prominent online broker, offering a range of trading services in the forex and CFD markets.

Product Offering: XM provides access to a diverse selection of financial instruments, including forex currency pairs, commodities, indices, metals, and energies. It caters primarily to retail traders.

Regulation: XM is regulated by multiple financial authorities globally, including CySEC in Cyprus, ASIC in Australia, and the FCA in the United Kingdom. This regulatory oversight ensures client fund protection and adherence to industry standards.

Trading Platforms: XM offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular trading platforms in the industry. These platforms are renowned for their advanced charting tools and algorithmic trading capabilities.

Global Presence: With clients in over 190 countries and multilingual support, XM serves a diverse international client base, providing access to global financial markets.

Educational Resources: XM provides an array of educational materials, including webinars, seminars, video tutorials, and daily market analysis, to help traders enhance their trading skills and knowledge.

Customer Support: The broker offers customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: XM offers risk management tools, including stop-loss and take-profit orders, as well as negative balance protection, to help traders manage risk effectively.

Leverage and Risk: Leverage is available, but traders should exercise caution, as it can amplify both profits and losses. Proper risk management is crucial.

Demo Accounts: Traders can open demo accounts to practice trading strategies and get accustomed to the platform without risking real capital.

Fees and Commissions: XM typically offers low spreads and competitive fees, making it appealing to cost-conscious traders.

HotForex

Company Overview: HotForex, founded in 2010, has earned a solid reputation in the online trading industry for providing a wide range of trading services and a client-centric approach.

Product Offering: HotForex offers access to various financial instruments, including forex currency pairs, commodities, indices, shares, cryptocurrencies, and bonds. It caters to both retail and institutional traders.

Regulation: The broker is regulated by multiple financial authorities in different jurisdictions, such as CySEC in Cyprus and the FCA in the United Kingdom, ensuring a high level of regulatory oversight and client fund protection.

Trading Platforms: HotForex offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced charting tools, technical analysis features, and automated trading capabilities. Additionally, they provide their proprietary platform called HotForex MetaTrader 4 (HF MT4).

Global Presence: With offices in various countries and multilingual support, HotForex serves clients from around the world, providing access to global financial markets.

Educational Resources: HotForex offers educational materials, including webinars, video tutorials, articles, and market analysis, to help traders improve their trading skills and understanding.

Customer Support: The broker provides customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: HotForex offers risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and control risk.

Leverage and Risk: Leverage is available, but traders should use it cautiously, as it can magnify both gains and losses. Effective risk management is essential.

Demo Accounts: Traders can open demo accounts to practice trading strategies and become familiar with the platform without risking real capital.

Fees and Commissions: HotForex offers competitive spreads and relatively low fees, making it appealing to traders looking for cost-effective trading.

FxPro

Company Overview: FxPro, founded in 2006, is a well-established online brokerage known for its commitment to innovation and excellence in online trading services.

Product Offering: FxPro offers access to a wide range of financial instruments, including forex currency pairs, commodities, indices, shares, cryptocurrencies, and futures. It caters to both individual retail traders and institutional clients.

Regulation: The broker is regulated by multiple financial authorities globally, including the FCA in the United Kingdom and CySEC in Cyprus, ensuring strict compliance with industry regulations and client fund safety.

Trading Platforms: FxPro provides various trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary platform, FxPro Edge. These platforms are known for their advanced features, technical analysis tools, and trading flexibility.

Global Presence: With offices and clients in numerous countries, FxPro serves a diverse international client base, providing access to global financial markets.

Educational Resources: FxPro offers educational materials, including webinars, articles, video tutorials, and market analysis, to help traders enhance their trading knowledge and skills.

Customer Support: The broker offers comprehensive customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: FxPro provides risk management tools like stop-loss and take-profit orders, helping traders effectively manage their positions and control risk.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can amplify both profits and losses. FxPro encourages responsible trading and risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and familiarize themselves with the platform without risking real capital.

Fees and Commissions: FxPro typically offers competitive spreads and transparent fee structures, appealing to traders looking for cost-effective trading.

Alpari

Company Overview: Alpari is a global online brokerage known for its long-standing presence in the forex market. It has grown to become one of the largest retail forex brokers in the world.

Product Offering: Alpari offers access to a wide range of financial instruments, including forex currency pairs, commodities, indices, and cryptocurrencies. It caters to both retail traders and institutional clients.

Regulation: Alpari operates under the regulatory oversight of various financial authorities in different jurisdictions, including the Financial Commission and FSC in the St. Vincent and the Grenadines. The level of regulatory oversight can vary depending on the entity within the Alpari Group.

Trading Platforms: The broker provides access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, offering advanced charting tools, technical analysis features, and algorithmic trading capabilities.

Global Presence: With offices in multiple countries and multilingual support, Alpari serves clients from around the world, providing access to international financial markets.

Educational Resources: Alpari offers educational materials, including webinars, articles, video tutorials, and market analysis, to help traders improve their trading knowledge and skills.

Customer Support: The broker provides customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: Alpari offers risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and control risk.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can magnify both profits and losses. Alpari emphasizes the importance of risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and get familiar with the platform without risking real capital.

Fees and Commissions: Alpari typically offers competitive spreads and fees, although the specific fee structure can vary depending on the account type and trading conditions.

FXPro

Company Overview: FXPro was founded in 2006 and has since gained a strong reputation as a leading online broker, serving a diverse clientele, including retail traders and institutional investors.

Product Offering: FXPro offers access to an extensive array of financial instruments, including forex currency pairs, commodities, indices, stocks, and cryptocurrencies, providing a comprehensive selection for traders.

Regulation: The broker operates under the regulatory oversight of various financial authorities, including the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC), ensuring regulatory compliance and client fund safety.

Trading Platforms: FXPro provides traders with access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), renowned for their advanced charting tools, technical analysis features, and algorithmic trading capabilities. Additionally, the broker offers its proprietary platform, FXPro Edge.

Global Presence: With offices in multiple countries and multilingual support, FXPro serves clients from around the world, offering access to global financial markets.

Educational Resources: FXPro offers educational materials, webinars, articles, and market analysis to help traders improve their trading knowledge and skills.

Customer Support: The broker provides customer support services through various channels, such as phone, email, live chat, and a client portal, assisting clients with inquiries and technical issues.

Risk Management: FXPro offers risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and mitigate potential losses.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can magnify both profits and losses. FXPro emphasizes the importance of proper risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and become familiar with the platform without risking real capital.

Fees and Commissions: FXPro typically offers competitive spreads and a transparent fee structure, making it appealing to traders seeking cost-effective trading.

CMC Market

Company Overview: CMC Markets was founded in 1989 and has evolved into a prominent online trading platform with a global presence, offering services to both retail traders and institutional clients.

Product Offering: CMC Markets provides access to an extensive array of financial instruments, including forex currency pairs, commodities, indices, cryptocurrencies, stocks, and more, offering a diverse set of trading opportunities.

Regulation: The broker is regulated by multiple financial authorities worldwide, including the Financial Conduct Authority (FCA) in the United Kingdom and the Australian Securities and Investments Commission (ASIC), ensuring strong regulatory compliance and client fund protection.

Trading Platforms: CMC Markets offers a proprietary trading platform known for its user-friendly interface, advanced charting tools, and powerful trading features. Additionally, clients can access the popular MetaTrader 4 (MT4) platform.

Global Presence: With a presence in various countries and multilingual support, CMC Markets serves a global clientele, providing access to global financial markets.

Educational Resources: The broker offers a range of educational materials, including webinars, articles, video tutorials, and market analysis, to help traders improve their trading knowledge and skills.

Customer Support: CMC Markets provides customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: The broker offers risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and control risk effectively.

Leverage and Risk: Leverage is available, but traders should use it cautiously, as it can magnify both profits and losses. CMC Markets encourages responsible trading and risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and become familiar with the platform without risking real capital.

Fees and Commissions: CMC Markets is known for its competitive spreads and transparent fee structure, making it appealing to traders seeking cost-effective trading.

XTB

Company Overview: XTB was founded in 2002 and has grown into a reputable online broker known for its comprehensive trading services and strong emphasis on education.

Product Offering: XTB offers access to a diverse range of financial instruments, including forex currency pairs, commodities, indices, cryptocurrencies, and shares, catering primarily to retail traders.

Regulation: The broker is regulated by multiple financial authorities globally, including the Financial Conduct Authority (FCA) in the United Kingdom and the Polish Financial Supervision Authority (KNF), ensuring robust regulatory compliance and client fund protection.

Trading Platforms: XTB provides the MetaTrader 4 (MT4) platform, a popular choice among traders for its advanced charting tools and technical analysis features. Additionally, it offers its proprietary platform, xStation, known for its intuitive design and powerful trading capabilities.

Global Presence: With a presence in numerous countries and multilingual support, XTB serves a diverse international client base, offering access to global financial markets.

Educational Resources: XTB places a strong emphasis on education, offering a wide range of educational materials, including webinars, articles, video tutorials, and market analysis, to help traders enhance their trading knowledge and skills.

Customer Support: The broker provides customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: XTB offers risk management tools like stop-loss and take-profit orders to help traders manage their positions and mitigate potential losses.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can magnify both profits and losses. XTB emphasizes the importance of proper risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and become familiar with the platform without risking real capital.

Fees and Commissions: XTB typically offers competitive spreads and transparent fee structures, making it appealing to traders looking for cost-effective trading.

Tickmill

Company Overview: Tickmill was founded in 2014 and has gained recognition as a global online brokerage offering a wide range of trading services.

Product Offering: Tickmill provides access to various financial instruments, including forex currency pairs, commodities, indices, and cryptocurrencies, catering to a diverse client base.

Regulation: The broker is regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the United Kingdom and the Seychelles Financial Services Authority (FSA), ensuring regulatory compliance and client fund protection.

Trading Platforms: Tickmill offers the popular MetaTrader 4 (MT4) platform, known for its advanced charting tools, technical analysis features, and algorithmic trading capabilities. Additionally, it provides the MetaTrader 5 (MT5) platform and its proprietary platform, WebTrader.

Global Presence: With offices in various countries and multilingual support, Tickmill serves a global clientele, offering access to international financial markets.

Educational Resources: The broker offers educational materials, including webinars, articles, video tutorials, and market analysis, to help traders enhance their trading knowledge and skills.

Customer Support: Tickmill provides customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: Tickmill offers risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and control risk effectively.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can magnify both profits and losses. Tickmill encourages proper risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and become familiar with the platform without risking real capital.

Fees and Commissions: Tickmill typically offers competitive spreads and a transparent fee structure, making it attractive to cost-conscious traders.

FXOpen

Company Overview: FXOpen was established in 2005 and has since become a prominent online broker, offering services to both retail and institutional traders.

Product Offering: FXOpen provides access to a wide array of financial instruments, including forex currency pairs, commodities, indices, cryptocurrencies, and CFDs (Contract for Difference), catering primarily to retail traders.

Regulation: The broker operates under regulatory oversight from multiple financial authorities, including the Financial Commission and FSA in Saint Vincent and the Grenadines, ensuring a degree of regulatory compliance and client fund safety.

Trading Platforms: FXOpen offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced charting tools, technical analysis features, and algorithmic trading capabilities. Additionally, it provides its proprietary platform, TickTrader.

Global Presence: With clients in numerous countries and multilingual support, FXOpen serves a global clientele, offering access to international financial markets.

Educational Resources: FXOpen offers educational materials, webinars, articles, video tutorials, and market analysis to assist traders in enhancing their trading knowledge and skills.

Customer Support: The broker provides customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: FXOpen offers risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and control risk effectively.

Leverage and Risk: Leverage is available, but traders should use it cautiously, as it can magnify both profits and losses. FXOpen emphasizes responsible trading and risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and become familiar with the platform without risking real capital.

Fees and Commissions: FXOpen is known for its competitive spreads and a transparent fee structure, making it appealing to traders looking for cost-effective trading.

RoboForex

Company Overview: RoboForex was founded in 2009 and has since become a respected online broker, offering trading services to both retail and institutional clients.

Product Offering: RoboForex provides access to an extensive selection of financial instruments, including forex currency pairs, commodities, indices, stocks, cryptocurrencies, and CFDs (Contract for Difference), catering to a diverse clientele.

Regulation: The broker is regulated by various financial authorities, depending on the region and entity, including the International Financial Services Commission (IFSC) in Belize, ensuring regulatory compliance and client fund protection.

Trading Platforms: RoboForex offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced charting tools, technical analysis features, and algorithmic trading capabilities. Additionally, the broker provides its proprietary platform, R Trader.

Global Presence: With clients in numerous countries and multilingual support, RoboForex serves a global clientele, providing access to international financial markets.

Educational Resources: The broker offers educational materials, webinars, articles, video tutorials, and market analysis to help traders improve their trading knowledge and skills.

Customer Support: RoboForex provides customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: RoboForex offers risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and mitigate potential losses.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can magnify both profits and losses. RoboForex emphasizes responsible trading and risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and get familiar with the platform without risking real capital.

Fees and Commissions: RoboForex typically offers competitive spreads and a transparent fee structure, making it appealing to traders seeking cost-effective trading.

Swissquote

Company Overview: Swissquote Group Holding Ltd was founded in 1996 and has grown into a leading Swiss online banking and financial institution, offering a wide array of financial services to retail and institutional clients.

Product Offering: Swissquote provides access to various financial products, including forex currency pairs, commodities, indices, stocks, cryptocurrencies, and more. It caters to traders and investors seeking a broad range of investment opportunities.

Regulation: The company operates under the regulatory oversight of the Swiss Financial Market Supervisory Authority (FINMA), which is known for its stringent regulations, ensuring a high level of security and client fund protection.

Trading Platforms: Swissquote offers its proprietary trading platform, Swissquote Advanced Trader, alongside the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, renowned for their advanced charting tools, technical analysis features, and algorithmic trading capabilities.

Global Presence: While Swissquote is based in Switzerland, it serves clients internationally and offers multilingual support, providing access to global financial markets.

Educational Resources: Swissquote offers educational materials, webinars, articles, and market analysis to help traders and investors enhance their financial knowledge and skills.

Customer Support: The company provides customer support services through various channels, including phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: Swissquote offers risk management tools, including stop-loss and take-profit orders, as well as access to various research and analysis resources to help clients make informed trading decisions.

Leverage and Risk: Leverage is available, but Swissquote encourages responsible trading and risk management, given that leverage can magnify both gains and losses.

Demo Accounts: Traders can open demo accounts to practice trading strategies and get acquainted with the platform without risking real capital.

Fees and Commissions: Swissquote’s fee structure varies depending on the specific financial products and services used, with competitive pricing for various trading instruments.

FP Markets

Company Overview: FP Markets was founded in 2005 and has since earned a strong reputation as a reliable online broker, serving both retail and institutional traders.

Product Offering: FP Markets provides access to an extensive selection of financial instruments, including forex currency pairs, commodities, indices, cryptocurrencies, shares, and CFDs (Contract for Difference), catering to traders with diverse investment interests.

Regulation: The broker is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), ensuring robust regulatory compliance and client fund protection.

Trading Platforms: FP Markets offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, renowned for their advanced charting tools, technical analysis features, and algorithmic trading capabilities. Additionally, it provides the IRESS platform for share trading.

Global Presence: While FP Markets is headquartered in Australia, it serves clients globally, offering multilingual support and access to international financial markets.

Educational Resources: The broker offers educational materials, webinars, articles, video tutorials, and market analysis to assist traders in enhancing their trading knowledge and skills.

Customer Support: FP Markets provides customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: The broker offers risk management tools like stop-loss and take-profit orders, helping traders manage their positions and control risk effectively.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can magnify both profits and losses. FP Markets emphasizes the importance of responsible trading.

Demo Accounts: Traders can open demo accounts to practice trading strategies and become familiar with the platform without risking real capital.

Fees and Commissions: FP Markets typically offers competitive spreads and a transparent fee structure, making it attractive to traders seeking cost-effective trading.

EXNESS Group

Company Overview: EXNESS Group was founded in 2008 and has since become a reputable online broker, serving a global clientele, including retail and institutional traders.

Product Offering: EXNESS offers access to a diverse selection of financial instruments, including forex currency pairs, commodities, indices, cryptocurrencies, and CFDs (Contract for Difference), providing a comprehensive range of trading opportunities.

Regulation: The broker operates under regulatory oversight from various authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the United Kingdom, ensuring regulatory compliance and client fund safety.

Trading Platforms: EXNESS provides the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced charting tools, technical analysis features, and algorithmic trading capabilities.

Global Presence: With clients in numerous countries and multilingual support, EXNESS serves a diverse international client base, offering access to global financial markets.

Educational Resources: The broker offers educational materials, webinars, articles, video tutorials, and market analysis to assist traders in enhancing their trading knowledge and skills.

Customer Support: EXNESS provides customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: The broker offers risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and control risk effectively.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can magnify both profits and losses. EXNESS emphasizes responsible trading and risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and become familiar with the platform without risking real capital.

Fees and Commissions: EXNESS typically offers competitive spreads and a transparent fee structure, making it appealing to traders looking for cost-effective trading.

City Index

Company Overview: City Index was established in 1983 and has evolved into a well-regarded online trading platform, offering a wide array of trading services to retail and professional traders.

Product Offering: City Index provides access to an extensive selection of financial instruments, including forex currency pairs, commodities, indices, shares, cryptocurrencies, and CFDs (Contract for Difference), catering to traders with diverse investment interests.

Regulation: The broker is regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the United Kingdom and the Australian Securities and Investments Commission (ASIC), ensuring strong regulatory compliance and client fund protection.

Trading Platforms: City Index offers its proprietary Advantage Web trading platform, known for its user-friendly interface, advanced charting tools, and technical analysis features. Additionally, clients can use the popular MetaTrader 4 (MT4) platform.

Global Presence: With a presence in various countries and multilingual support, City Index serves a global clientele, providing access to international financial markets.

Educational Resources: The broker offers educational materials, webinars, articles, video tutorials, and market analysis to help traders improve their trading knowledge and skills.

Customer Support: City Index provides customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: The broker offers risk management tools, including stop-loss and take-profit orders, helping traders manage their positions and control risk effectively.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can magnify both profits and losses. City Index emphasizes responsible trading and risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and become familiar with the platform without risking real capital.

Fees and Commissions: The City Index’s fee structure varies depending on the specific financial products and services used, with competitive pricing for various trading instruments.

InstaForex

Company Overview: InstaForex was founded in 2007 and has since become a prominent online broker, serving a diverse clientele, including retail traders, institutional investors, and beginners.

Product Offering: InstaForex provides access to an extensive array of financial instruments, including forex currency pairs, commodities, indices, cryptocurrencies, and CFDs (Contract for Difference), offering a comprehensive range of trading options.

Regulation: The broker operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC) and the British Virgin Islands Financial Services Commission (FSC), ensuring regulatory compliance and client fund safety.

Trading Platforms: InstaForex offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, renowned for their advanced charting tools, technical analysis features, and algorithmic trading capabilities.

Global Presence: With a strong international presence and multilingual support, InstaForex serves clients from various countries, providing access to global financial markets.

Educational Resources: InstaForex offers a range of educational materials, webinars, articles, video tutorials, and market analysis to help traders enhance their trading knowledge and skills.

Customer Support: The broker provides customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: InstaForex offers risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and control risk effectively.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can magnify both profits and losses. InstaForex emphasizes responsible trading and risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and become familiar with the platform without risking real capital.

Fees and Commissions: InstaForex typically offers competitive spreads and a transparent fee structure, making it appealing to traders looking for cost-effective trading.

AIpari Group

Company Overview: Alpari Group was founded in 1998 and has established a global presence in the online trading industry, offering a range of financial services to retail and institutional clients.

Product Offering: Alpari provides access to a variety of financial instruments, including forex currency pairs, commodities, indices, cryptocurrencies, and CFDs (Contract for Difference), catering to traders with diverse investment interests.

Regulation: The group operates under regulatory oversight from various financial authorities, depending on the region and entity, ensuring regulatory compliance and client fund safety.

Trading Platforms: Alpari offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced charting tools, technical analysis features, and algorithmic trading capabilities.

Global Presence: With a presence in numerous countries and multilingual support, Alpari serves a global clientele, providing access to international financial markets.

Educational Resources: Alpari offers a range of educational materials, webinars, articles, video tutorials, and market analysis to help traders enhance their trading knowledge and skills.

Customer Support: The company provides customer support services through various channels, such as phone, email, live chat, and a client portal, to assist clients with inquiries and technical issues.

Risk Management: Alpari offers risk management tools, including stop-loss and take-profit orders, to help traders manage their positions and control risk effectively.

Leverage and Risk: Leverage is available, but traders should use it responsibly, as it can magnify both profits and losses. Alpari emphasizes responsible trading and risk management.

Demo Accounts: Traders can open demo accounts to practice trading strategies and become familiar with the platform without risking real capital.

Fees and Commissions: Alpari’s fee structure varies depending on the specific financial products and services used, with competitive pricing for various trading instruments.